The U.S. Dollar Index (DXY) measures the value of the dollar against a basket of six foreign currencies: the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc. Before the creation of the euro, the index included ten currencies—the ones currently included (except the euro), plus the German mark, French franc, Italian lira, Dutch guilder, and Belgian franc. The euro replaced the latter five.

Sources: Bloomberg Finance L.P., DWS Investment GmbH, as of 07/21/2025.

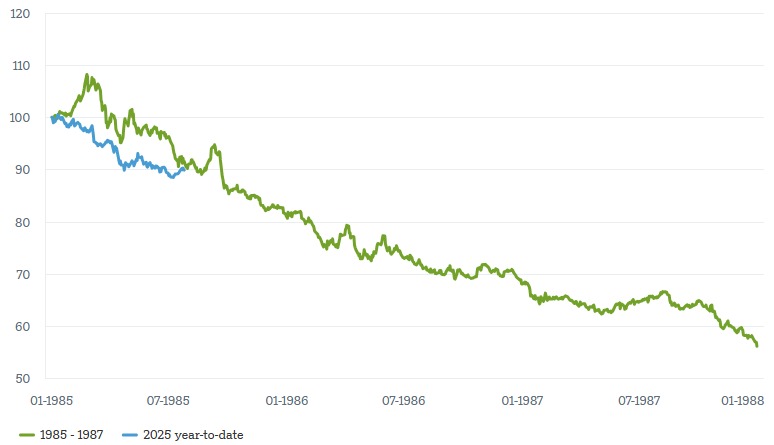

Our chart highlights that the sharp decline in the dollar so far in 2025 follows a path similar to the dollar’s drop in the early phase of the Plaza Accord in 1985[4]. There are parallels with the past that suggest a continued depreciation of the dollar in the coming years. The current U.S. president is focused on strengthening the manufacturing sector and reducing the trade deficit. At the same time, political uncertainty in the U.S. is rising, and central banks are gradually reducing their dollar holdings in favor of gold, the euro, or the Chinese renminbi. Meanwhile, European countries are actively stimulating their own economies.

However, the downward trend of the dollar may not be as intense or rapid as in 1985, mainly because there are no coordinated cross-border agreements to weaken the currency. Instead, the change in the dollar’s value appears to be driven by shifts in investor sentiment, with growing doubts about the U.S. as a safe haven[5], prompting capital reallocation.

We are closely monitoring the dollar’s movement, but we currently do not see major risks of a massive and rapid devaluation. The dollar remains the undisputed global currency due to its high liquidity, its status as the most traded currency in the world, the size of the U.S. economy, and the depth and efficiency of its financial markets. At present, there is no single and realistic alternative capable of replacing it. Our longer-term forecasts assume a continued weakening of the U.S. currency, but not a dramatic devaluation comparable to the Plaza Accord[6].

Opinion Piece by Xueming Song, Currency Strategist at DWS

References

See “Global FX trading hits record $7.5 trln a day – BIS survey,” Reuters; as of October 2022

See “U.S. Dollar Defends Role as Global Currency,” Statista; as of January 2025

See “The Plaza Accord 30 Years Later,” scholar.harvard.edu; as of December 2015

Bloomberg Finance L.P.; as of July 21, 2025

Financial safe havens are investments or assets that are expected to retain or increase in value during times of market turbulence.

For a more detailed assessment, read our CIO Special, “First Cracks in the Dollar’s Dominance,” as of 7/16/25.

This information is subject to change at any time, based upon economic, market and other considerations and should not be construed as a recommendation. Past performance is not indicative of future returns. Forecasts are based on assumptions, estimates, opinions and hypothetical models that may prove to be incorrect. Alternative investments may be speculative and involve significant risks including illiquidity, heightened potential for loss and lack of transparency. Alternatives are not suitable for all clients. Source: DWS Investment GmbH.

DWS and FundsSociety are not affiliated.

This information is subject to change at any time, based upon economic, market and other considerations and should not be construed as a recommendation. Past performance is not indicative of future returns. Forecasts are not a reliable indicator of future performance. Forecasts are based on assumptions, estimates, opinions and hypothetical models that may prove to be incorrect. Alternative investments may be speculative and involve significant risks including illiquidity, heightened potential for loss and lack of transparency. Alternatives are not suitable for all clients. Source: DWS Investment GmbH.

Important information – EMEA, APAC & LATAM

DWS is the brand name of DWS Group GmbH & Co. KGaA and its subsidiaries under which they do business. The DWS legal entities offering products or services are specified in the relevant documentation. DWS, through DWS Group GmbH & Co. KGaA, its affiliated companies and its officers and employees (collectively “DWS”) are communicating this document in good faith and on the following basis.

This document is for information/discussion purposes only and does not constitute an offer, recommendation or solicitation to conclude a transaction and should not be treated as investment advice.

This document is intended to be a marketing communication, not a financial analysis. Accordingly, it may not comply with legal obligations requiring the impartiality of financial analysis or prohibiting trading prior to the publication of a financial analysis.

This document contains forward looking statements. Forward looking statements include, but are not limited to assumptions, estimates, projections, opinions, models and hypothetical performance analysis. No representation or warranty is made by DWS as to the reasonableness or completeness of such forward looking statements. Past performance is no guarantee of future results.

The information contained in this document is obtained from sources believed to be reliable. DWS does not guarantee the accuracy, completeness or fairness of such information. All third party data is copyrighted by and proprietary to the provider. DWS has no obligation to update, modify or amend this document or to otherwise notify the recipient in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

Investments are subject to various risks. Detailed information on risks is contained in the relevant offering documents.

No liability for any error or omission is accepted by DWS. Opinions and estimates may be changed without notice and involve a number of assumptions which may not prove valid.

DWS does not give taxation or legal advice.

This document may not be reproduced or circulated without DWS’s written authority.

This document is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, including the United States, where such distribution, publication, availability or use would be contrary to law or regulation or which would subject DWS to any registration or licensing requirement within such jurisdiction not currently met within such jurisdiction. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions.

106928-1 (8/25) (ORIG: RBA0037_082244_207 As of 7/22/25