Political and Regulatory Decisions Have Become the Main Drivers of Investment Strategy, Leading Sovereign Investors to Fundamentally Reassess Portfolio Construction and Risk Management, According to the 13th Annual Invesco Global Sovereign Asset Management Study.

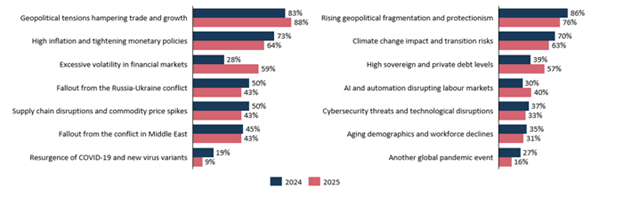

While geopolitical tensions (88%) and inflationary pressures (64%) remain the main short-term risks for sovereign wealth funds and central banks, concern over excessive volatility in financial markets has increased—cited by 59% of respondents, up from 28% in 2024. Nearly 90% believe that geopolitical competition will be a key driver of volatility, while 85% expect protectionist policies to entrench persistent inflation in developed economies. Specifically, 62% of those surveyed now see deglobalization as a major threat to investment returns, highlighting a marked shift in market narrative.

The Invesco Study—One of the Leading Indicators of Sovereign Wealth Fund and Central Bank Behavior—Is Based on the Views of 141 Senior Investment Professionals, including Chief Investment Officers, Heads of Asset Classes, and Portfolio Strategy Leads, from 83 sovereign wealth funds and 58 central banks around the world, collectively managing $27 trillion in assets.

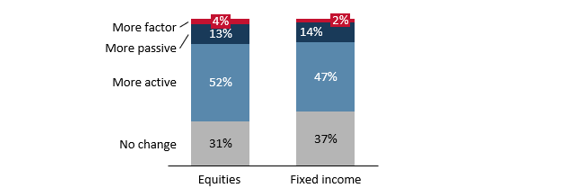

Active Strategies Gain Ground Alongside Core Passive Exposure

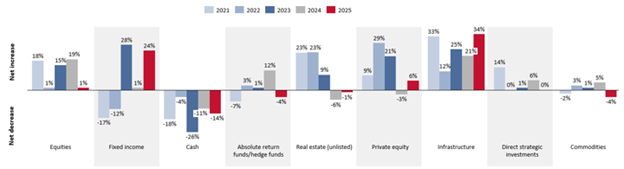

One of the key changes in portfolio structuring identified in the study is the increased use of active strategies by respondents. On average, sovereign wealth funds and central banks hold more than 70% of their portfolios in active strategies, both in fixed income and equities.

The survey revealed that 52% of sovereign investors plan to increase their active equity exposure over the next two years, while 47% plan to do the same with fixed income. This shift is more pronounced among the largest institutions: 75% of sovereign investors managing over $100 billion have adopted more active equity strategies over the past two years, compared to 43% of mid-sized investors and 36% of smaller ones.

While the normalization of interest rates and rising yields have contributed to this rebound, fixed income has also taken on a broader role—as both a liquidity management tool and a flexible source of returns and portfolio resilience.

As allocations to private markets increase, portfolios are becoming increasingly illiquid, making liquidity management a key strategic priority.

As a result, nearly 60% of sovereign investors report using formalized liquidity frameworks, with segments of their fixed income portfolios specifically positioned to offset the illiquidity of their private market exposures.

“Fixed income is no longer limited to defensive, risk-free positioning—it has become a dynamic and versatile part of the portfolio. As the market structures change, liquidity needs grow, and return-risk assumptions evolve, fixed income is taking on a broader role in strategic portfolio management, fulfilling multiple functions simultaneously rather than acting solely as a defensive anchor,” says Rod Ringrow, Head of Official Institutions at Invesco.

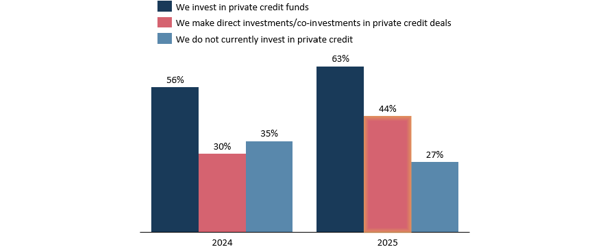

Private Fixed Income Gains Traction as a New Diversification Tool

Investment in private fixed income continues to gain momentum among sovereign wealth funds, with the proportion accessing this asset class through direct investments or co-investments rising from 30% in 2024 to 44% in 2025. Fund-based access also increased, from 56% to 63%, and 50% of sovereign funds plan to increase allocations over the next year, led by institutions in North America (68%).

This growing interest reflects a broader rethinking of diversification, as traditional correlations between equities and bonds erode in an environment of higher rates and elevated inflation.

Sovereign debt investors are turning to private credit to gain exposure to floating rates, customized deal structures, and return profiles that are less correlated with public markets. Private debt, once considered a niche asset class, is now viewed as a strategic pillar for building long-term portfolios.

“Private fixed income is an excellent example of how sovereign investors are adapting to a structurally different market environment. They are building portfolios that prioritize resilience and flexibility, and private fixed income offers exactly that—providing both scalability and greater control,” says Rod Ringrow.

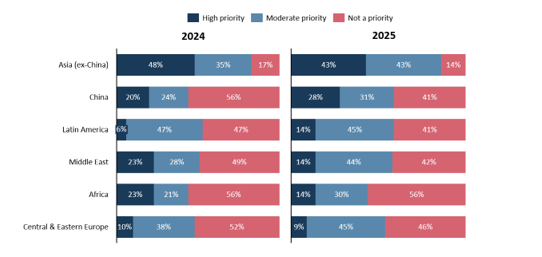

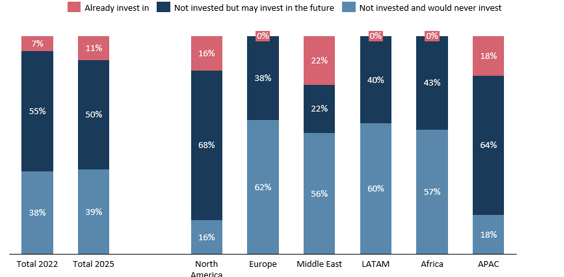

China Reemerges as a Strategic Priority in a Fragmented Emerging Markets Landscape

Sovereign wealth funds are taking a more selective approach to emerging markets. However, Asia excluding China remains a priority for 43% of respondents. China continues to be one of the main areas of focus, rising from 20% in 2024 to 28%. Sovereign funds are increasingly directing their strategies in China toward specific technology sectors such as artificial intelligence, semiconductors, electric vehicles, and renewable energy.

78% of respondents believe that China’s technological and innovation capabilities will be globally competitive in the future.

A surprise in the study was the growing interest from some sovereign wealth funds in so-called stablecoins, particularly among those in emerging markets. They are considered easier to integrate than traditional cryptocurrencies due to their price stability and potential for real-world application. This makes them more suitable for future cross-border payment systems or liquidity management tools.

Many sovereign funds still prefer indirect exposure—investing through venture capital vehicles, innovation platforms, or structure-related funds—rather than holding direct stakes. However, this shift toward direct investment, though small, reflects a move from abstract interest to real-world participation.

Central banks are simultaneously advancing their own central bank digital currency (CBDC) initiatives, balancing the potential for innovation with considerations of systemic stability. CBDCs offer potential advantages: in emerging markets, they aim to improve financial inclusion and modernize payments, while in developed markets, they focus on payment efficiency and monetary sovereignty. However, most central banks remain in research or pilot phases due to the complexity of risk.

Central Bank Resilience and the Defensive Role of Gold

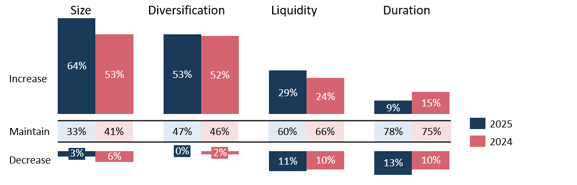

Central banks are strengthening their reserve management frameworks in response to growing geopolitical instability and fiscal uncertainty. Nearly two-thirds (64%) of central banks plan to increase their reserves over the next two years, while 53% intend to further diversify their portfolios.

Gold continues to play a central role in this effort, with 47% of central banks expecting to increase their gold allocations over the next three years. Seen as a politically neutral store of value, gold is increasingly viewed as a strategic hedge against risks such as rising U.S. debt levels, the weaponization of reserves, and global fragmentation.

At the same time, central banks are modernizing the way they manage their gold exposures. In addition to physical holdings, more institutions are turning to dynamic tools such as ETFs, swaps, and derivatives to adjust allocations, enhance liquidity management, and increase overall portfolio flexibility—without sacrificing defensive protection. This trend is expected to continue, as 21% of respondents say they plan to invest in gold ETFs over the next five years, up from 16% currently, while the number of respondents planning to invest in gold derivatives is set to double, rising from 9% to 19%.

By Fórmate a Fondo

By Fórmate a Fondo