For months, July 9 has been circled on the calendar as the deadline for several countries—including the European Union, India, Canada, the United Kingdom, and Vietnam—to reach a trade agreement with the U.S. So far, only the last two have secured deals: the United Kingdom maintains base tariffs of 10%, and Vietnam obtained a reduced rate of 20%, while China has signed a trade truce. Talks with the EU, India, and Canada remain ongoing.

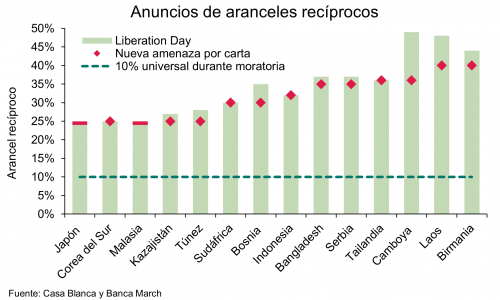

If the pending agreements are not finalized by tomorrow, the next step from the Trump administration is clear: it will issue formal notifications, in the form of letters, signaling the implementation of new tariffs effective August 1. In fact, in a shift in strategy, Trump has already announced that several such letters have been sent to countries where negotiations are stalling. “Among the 14 letters sent, two key trading partners stand out: Japan, which accounts for 4.5% of U.S. imports, and South Korea, with 4%. Both countries will face a 25% tariff. In most cases, the proposed tariffs are very similar to those introduced on Liberation Day, and a new period of dialogue will open until August 1—a deadline the president described as ‘not 100% firm,’ allowing for additional flexibility. Finally, it is worth noting that several of the countries affected by the letters have served as routes for China to reroute exports to the U.S., such as Thailand and Laos,” summarize analysts at Banca March.

Still, amid this trade realignment, the U.S. financial market remains firm: the S&P 500 is headed for its third consecutive monthly gain. “Global financial markets are navigating a week of heightened trade tension, political sensitivity, and mixed macroeconomic signals, with the United States at the center of a tariff realignment with global implications. Statements by Treasury Secretary Scott Bessent have set the tone, with repeated assertions about the U.S. returning to a regime of non-inflationary economic growth, accompanied by new rounds of multilateral and bilateral trade agreements. The Trump administration is preparing to impose tariffs starting August 1 that could revert to the peak levels of April 2 if negotiations with trade partners fail, triggering a chain reaction of adjustments, multilateral criticism, and regulatory uncertainty,” said Felipe Mendoza, financial markets analyst at ATFX LATAM.

In his view, the U.S. appears determined to consolidate a new protectionist cycle. “The tariff letters have already begun to be sent—as Donald Trump himself announced—to dozens of countries in an effort to strengthen the U.S. position in trade negotiations. Bessent confirmed that a series of agreement announcements is expected over the next 48 hours, while also stating that the trade deal with Vietnam is already finalized in principle, establishing a reciprocal tariff of 20%. Meanwhile, talks continue with the EU over a possible extension to avoid sanctions, while threats remain in place for a 17% tariff on European food exports,” he added.

Negotiations on the Table

Assessments of how these trade talks are progressing abound. For instance, Muzinich & Co highlights that U.S.–China relations appear to be in a relatively strong phase compared to recent history. “Last week, the United States lifted export restrictions on Chinese chip design software companies and ethane producers. In exchange, Beijing made concessions in the rare earth sector, signaling further goodwill between both sides. Additionally, China’s Caixin manufacturing index—the country’s leading private-sector and export-oriented business indicator—returned to expansion territory, reaching 50.4 in June. This far exceeded expectations of 49.3 and was a sharp rebound from May’s 48.3, suggesting a recovery in Chinese export activity,” they note.

Regarding Europe, they observe that headlines point to progress toward easing transatlantic trade tensions. “The European Union has shown a willingness to accept a trade agreement with the United States that includes a universal 10% tariff on a broad range of its exports. However, the EU is seeking concessions in return—specifically, pressure for quotas and exemptions that would effectively reduce the U.S. 25% tariff on EU auto and auto parts exports, as well as the 50% tariff on steel and aluminum,” they state.

Philippe Waechter, chief economist at Ostrum AM (an affiliate of Natixis IM), notes that although the 90-day extension expires July 9, Washington has already indicated that 25% tariffs on Japan and South Korea will begin August 1. “Announcements will be staggered through August 1, depending on how negotiations proceed. This hardline strategy was thought to be off the table after the financial market warnings around April 2 and due to America’s large funding needs. However, Trump is returning to it. And one can understand the reason behind this obstinacy,” he adds.

Beyond the Theater

Despite the political theater surrounding these tariff negotiations, David Kohal, chief economist at Julius Baer, believes the threat of higher tariffs remains—even though Trump extended the deadline from July 9 to August 1. This creates hurdles for U.S. investment and adds uncertainty around inflation.

In his view, the ongoing threat of higher tariffs heightens the risk of stagflation in the U.S. and puts pressure on Europe to boost domestic demand to counter challenges in global trade. “These new tariff threats—on top of the 10% base tariff, the 25% auto tariff, and the 50% tariffs on steel and aluminum already in place—serve as a reminder that the trade dispute remains unresolved, and the potential to disrupt U.S. supply chains and corporate investments may grow. Meanwhile, companies outside the U.S. are struggling in an increasingly hostile global environment,” says Kohal.

George Curtis, portfolio manager at TwentyFour Asset Management (Vontobel), believes that trade agreements are complex and difficult to negotiate, and that U.S. trade partners may not be sufficiently incentivized to concede to American demands.

“We believe President Trump will aim to negotiate toward a 10% baseline tariff, but the path to that outcome could be complicated, and the risk is that tariffs will end up higher, not lower—especially if the U.S. finds that other countries aren’t playing along. Ultimately, we expect Trump will outline the framework of a few deals in the coming weeks, but also impose new reciprocal tariffs on countries he views as negotiating unfairly. This is a tactic we’ve seen several times in recent months; however, we don’t necessarily believe markets will react strongly, assuming in the end it will de-escalate,” says Curtis.

Stirring the Tariffs

While the outcome of these negotiations remains to be seen, international asset managers agree that the most relevant factor continues to be the impact of this uncertainty on markets and growth prospects—for both the U.S. and the global economy.

“A global trade war and shifting political alliances could slow growth, fuel inflation, and raise the risk of recession. On the other hand, markets may react positively to announcements of trade talks. Four possible scenarios have emerged: a trade confrontation characterized by high tariffs and protectionist measures; major agreements, which would be the most favorable; a return of great powers; and assertive nationalism. Negotiations are ongoing, but given the complexity and number of trade partners involved, a quick resolution appears unlikely,” Capital Group states in its weekly analysis.

Meanwhile, Curtis of TwentyFour AM (Vontobel) believes that now that the Spending Act is known, the biggest short-term risk for Treasuries is headline news on tariffs and economic data. In his view, the U.S. economy is slowing, labor data will soften, but a recession is unlikely.

“So far, inflation figures have been favorable for cuts, as core inflation has exceeded forecasts for four straight months, but we don’t believe the Fed will act before tariff levels are set and it is confident that second-round effects have not been passed on to prices (unless job growth slows significantly). Deficits will continue to weigh on Treasuries in the coming years, as the government offers the market a new net supply of $2 trillion per year,” Curtis adds.

According to Ebury analysts, tariff-related news is expected to trigger market moves this week. However, they point out that, for now, markets are taking this risk calmly, assuming last-minute agreements or another extension will be announced, as Treasury Secretary Bessent has hinted. Their weekly analysis also notes that last week’s strong U.S. jobs report has temporarily halted the dollar’s slide and eliminated the chance of a Fed rate cut in July.

Less Tied to the U.S.

Another reflection from investment firms is the growing awareness that the global economy may, in the medium term, become less dependent on the United States and more diversified. As Waechter explains, since the time of Ronald Reagan, the global economic cycle has depended on U.S. household consumption, which represents 70% of U.S. GDP—the highest share by far among developed countries. As a result, many national economic cycles have become reliant on American consumer behavior.

“The American trap closes when, suddenly, countries have to pay a tariff to keep exporting to the U.S. To continue doing business with the U.S.—which is essential for almost every country’s economic cycle—nations accept being penalized by this tax. This leads to wealth transfers to the United States. The surge in customs duties collected by the U.S. Treasury proves it. This strategy, though not collectively efficient, also reveals the rest of the world’s inability to be self-sufficient. The U.S. market—so large and attractive for so long—is now ensnaring the rest of the world,” argues Waechter, chief economist at Ostrum AM.

A second conclusion is that the U.S. economy may be the one most affected by Trump’s tariffs. “If tariffs from the Trump administration are implemented—along with any retaliation from U.S. trade partners—it will lead to a supply shock in the U.S. and a demand shock elsewhere. The severity of these shocks will depend on the outcome of current trade talks and legal challenges. But it seems clear that the world’s two largest economies—China and the U.S.—will experience slower-than-expected growth compared to the beginning of the year, and the consequences will be felt globally, regardless of the final trade agreements,” say analysts at T. Rowe Price.

In their view, the U.S. faces downside risks to its growth outlook, even with the suspension of reciprocal tariffs with China and other partners. “Companies are facing higher input costs, which will compress profit margins and could force some to cut back on capital spending. Tariffs on consumer goods are likely to reduce real purchasing power and dampen household spending, which accounts for more than 70% of U.S. GDP. Any further downward pressure on the U.S. dollar could also activate upside inflation risks,” T. Rowe Price concludes.