Green, social, sustainability, and sustainability-linked bonds (GSS) are a relatively young asset class, established with the first green bond transactions just over a decade ago. In emerging markets, the outlook for this asset class remains solid, with the energy transition being the driver that has pushed their issuance over the past decade.

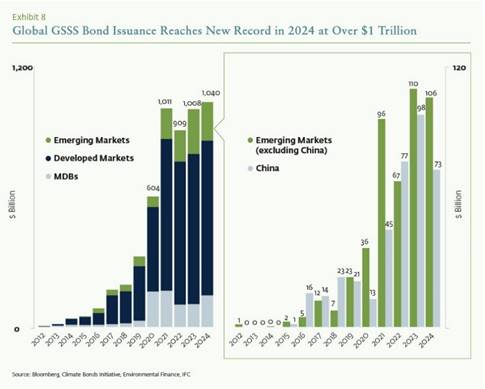

According to the latest report prepared by IFC and Amundi, global GSS bond issuance reached an all-time high of more than $1 trillion in 2024 in gross terms, 3% more than the previous year. However, the share of this asset class over total fixed income issuances declined to 2.2% in 2024, compared to 2.5% the previous year. These figures remain well above the 0.6% levels of 2018.

The report data show that, in emerging markets, GSS bond sales fell by 14% year-on-year. “Much of this decline is explained by lower issuance from China, as local investors opted for conventional bonds in the domestic market,” it explains in its conclusions. Additionally, it indicates that another factor behind the market’s retreat was a 23% contraction in global fixed income issuance in emerging markets outside China, amid weaker economic growth in Asia and Europe.

Despite this, the conclusions state that GSS bond penetration exceeded 5% in emerging markets excluding China, a record and ahead of the rates observed in the Asian giant and in developed markets.

Regarding pricing, the so-called green premium or greenium (a yield discount for GSS bond issuers) was cut by more than half, down to an estimated 1.2 basis points in 2024 from 2.5 bps in 2023, according to Amundi calculations. “In emerging markets, meanwhile, the greenium effectively disappeared in 2024, as supply caught up with demand for this type of asset,” they note.

Growth Drivers

At the time of drafting this report (April 2025), the global economy is facing high levels of uncertainty, making short-term forecasts for GSS bond issuance in emerging markets difficult. That said, the underlying market factors are clear, such as a likely rebound in new issuance to refinance around $330 billion in bonds approaching maturity over the next three years.

On the other hand, there are three factors that will likely limit new GSS bond sales: weaker global economic growth, recent regulatory changes in Europe, and a declining investor sentiment regarding environmental, social, and governance issues.

According to the report, over the longer term, the outlook for GSS bonds in emerging markets remains solid. “It is likely that in the coming years annual investments in clean energy that provide greater efficiency and supply security will double. This growth will likely be supported by an increasingly competitive renewable energy sector and by the ambitious commitments of multilateral institutions,” the report explains.

Increasing Diversification

Global cumulative GSS bond issuance between 2018 and 2024 reached approximately $5.1 trillion. During this period, issuers from emerging markets contributed around $800 billion or 16%. According to the report, “a key driver behind this growth is the energy transition from carbon-based generation to alternative, cleaner energy forms or technologies.”

In fact, clean energy investments in emerging markets have surged more than 70% since 2018, and China alone has experienced a 170% increase. Investor appetite has also intensified notably: sustainable funds reached $3.6 trillion in assets under management in 2024—up from $1.4 trillion in 2018—and fixed income allocations within investment portfolios have increased to 22%. Additionally, multilateral institutions channeled $238 billion in climate financing to emerging markets between 2016 and 2022, according to the OECD.

“The GSS bond market is undergoing significant diversification. Although green bonds have long dominated emerging markets’ GSS bond issuance, there is a growing shift toward sustainability bonds. This trend is pronounced among multilateral institutions and, more broadly, among issuers outside China who seek the flexibility of sustainability bonds to finance both environmental and social projects,” explained Yerlan Syzdykov, Global Head of Emerging Markets at Amundi.

The report observes that, since the end of the COVID-19 pandemic, demand for healthcare financing has subsequently contracted, leading to a stabilization in social bond sales. “This asset class represented 6% of total GSS bond issuance in emerging markets between 2022 and 2024. In contrast, sustainability-linked bonds experienced a sharp decline. This may reflect increasing criticism of their design flaws and weak penalty structures that do not effectively incentivize issuers to meet the sustainability targets set out in the terms of the assets,” the document concludes.