The escalating conflict between Israel and Iran has significant implications for the global oil market. Although Israeli attacks have so far mainly targeted military facilities and nuclear infrastructure, any expansion of the conflict into oil-producing areas—particularly if it affects Iraqi output—could remove around 5 million barrels per day from the market.

This would represent a critical reduction, considering that the spare capacity of OPEC+Russia, estimated at about 7.5 million barrels per day, would shrink by nearly 70%.

Such a scenario greatly increases the risk of a major global supply shock, potentially pushing oil prices back toward the psychologically significant $100 per barrel level.

Political Strategies and Likely Scenarios

While the most plausible scenario is that Iran will seek to preserve what remains of its nuclear capabilities and eventually return to negotiations with the United States, the current U.S. administration under Trump—marked by relative passivity and permissiveness toward Israel—creates the possibility of an intensification of the conflict.

Israel might view Iran’s current weakness—resulting from the damage inflicted on key allies such as Hamas, Hezbollah, and Assad’s former regime in Syria—as a unique opportunity to permanently neutralize the Iranian nuclear threat.

Some political analysts even suggest that Trump may have deliberately enabled this scenario in an effort to force a definitive resolution of the Iranian nuclear issue. However, an extreme escalation would inevitably provoke retaliation from Iran, especially if the survival of Ayatollah Ali Khamenei’s regime is perceived to be at stake.

A possible Iranian response could include attacks on Saudi oil facilities or a blockade of the strategic Strait of Hormuz, through which between 18 and 20 million barrels of crude oil and refined products transit daily. Such a situation would likely force the U.S. to reconsider its strategy, balancing the goal of eliminating the nuclear threat with maintaining a degree of regional stability under the current Iranian regime.

Economic and Financial Consequences

A severe oil supply shock would significantly increase global energy costs and slow down global economic growth. The impact would be particularly acute for economies heavily reliant on imported oil, such as Europe and China. A slowdown in China would be especially concerning given its central role in the current global economic context and its strategic interest in preventing further Middle Eastern tensions.

The United States, on the other hand, would be in a relatively more favorable position thanks to the energy independence it has achieved over the past decade. Nevertheless, it would not be immune to the secondary effects of a deep global slowdown. In this context, the perception of the U.S. dollar as a safe-haven asset could be strengthened, relatively favoring dollar-denominated assets—especially Treasury bonds and U.S. equities—compared to more vulnerable regions.

Market Reaction and Perception

In recent days, market risk indicators seem to have priced in the peak of the conflict, as reflected in relatively restrained movements across key assets. U.S. Treasury yields have risen slightly, while the dollar and gold have shown downward trends. Meanwhile, stock indexes have maintained surprising stability, seemingly downplaying the severity of potential risks.

This apparent calm could be supported by the reduced intensity of oil usage in global production compared to previous decades and the belief that the remaining spare capacity, although limited, could partially offset a temporary supply disruption from Iran and Iraq.

Complacency Risks in the Markets

However, the current stability may be overlooking critical factors. A sustained disruption of supply from the Middle East would be difficult to manage without causing significant price tensions, given the limited real spare capacity of OPEC+Russia in a prolonged conflict scenario.

Moreover, a genuine escalation could trigger important second-round effects, such as significant inflationary pressures that would force central banks to maintain restrictive monetary policies for a longer period, further slowing global economic activity.

Conclusion and Outlook

The Israel-Iran conflict has the potential to trigger a major global economic shock, the exact impact of which will largely depend on the duration and depth of the conflict, as well as the response capacity of key players in the international energy market.

The prevailing uncertainty requires close monitoring of developments in the Middle East. The complacency seen in the markets so far could be quickly reversed if tensions escalate further, once again highlighting the region’s critical importance to global economic stability.

For investors, maintaining defensive and diversified positions—especially in safe-haven assets—may be a prudent strategy while the evolution of the conflict and its geopolitical and economic implications become clearer.

Gold as a Strategic Asset

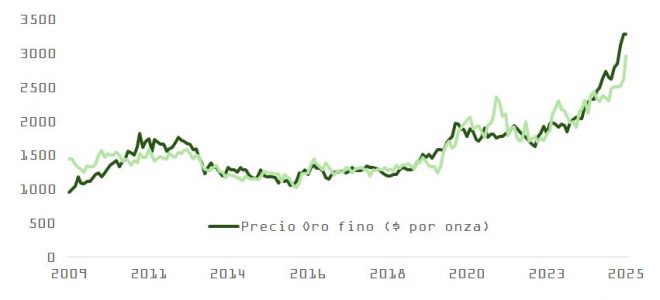

In this context, gold is an attractive asset. Despite its strong performance since 2023, our valuation model shows a slight deviation from its theoretical price.

Since the beginning of the Russia-Ukraine war in 2023, gold has become a strategic asset. Since then, countries like Russia, Turkey, India, and China have increased the gold holdings in their reserves, diversifying away from the U.S. dollar.

The percentage of international reserves invested in gold has risen from 20% to 24%, and it continues to grow. The potential for gold to remain a structural source of demand is clear when considering differences in country-level positioning. China, for example, has only invested 7% of its total foreign currency deposits in gold, meaning its purchases could support gold prices. Additionally, it’s worth noting that approximately 60% of gold demand comes from central banks and financial investments, and the appetite of central banks for this commodity is relatively insensitive to price fluctuations, as they do not seek economic returns.