Rates are up, markets are shaky, and the last AAA is gone. But it’s still the U.S.—the world’s anchor, and now, a bond market full of opportunity.

A Global Giant with Growing Pains

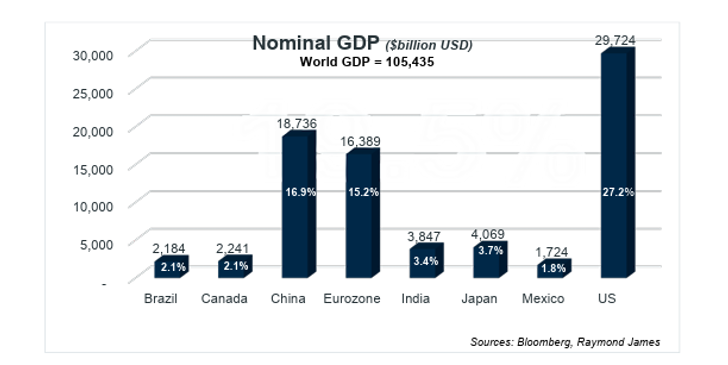

The United States remains the world’s largest economy, generating 27% of global GDP—61% more than China, the second largest at 16.9%. This economic dominance is backed by unmatched military power and the U.S. dollar’s role as the world’s primary reserve currency.

A Yield Curve Turning Upward

The U.S. Treasury yield curve has returned to a normal upward slope, signaling healthier financial markets and offering better rewards for long-term investors. This is a welcome development for those seeking predictable income and capital preservation in uncertain times.

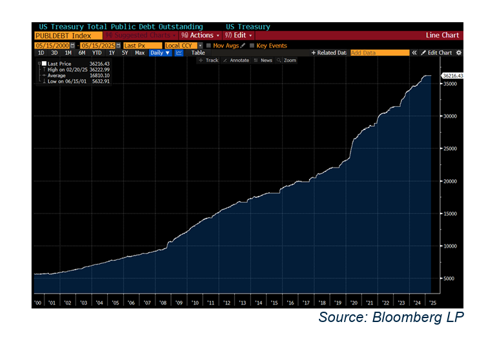

Debt: The Elephant in the Room

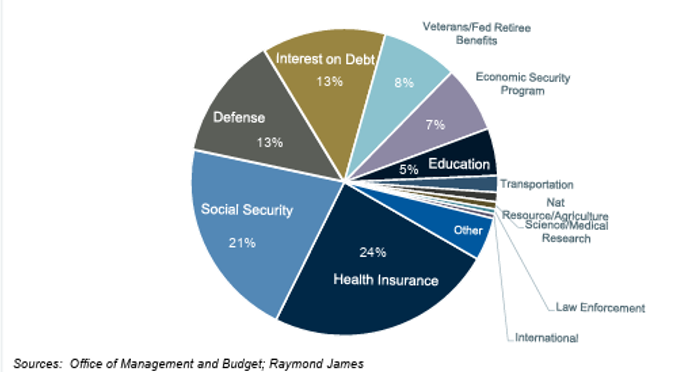

However, this optimism is tempered by a growing concern: the national debt has surpassed $36 trillion. Every American would need to pay over $100,000 to eliminate it. Interest payments alone consume about 13% of the federal budget—and could rise to 30% of tax revenue within a decade.

U.S. Treasury Downgrade—Same Strength, New Opportunities

The U.S. government now spends around 13% of its budget just on interest payments. If this were a household, it would be like spending a big chunk of your paycheck just to cover credit card interest—unsustainable without a raise. Similarly, while economic growth could help reduce the debt burden, it’s not something the country can count on.

Cutting spending is another option, but politically difficult. The largest budget items—healthcare, Social Security, and defense—are hard to touch. Reducing entitlements is unpopular, and cutting defense is rarely on the table.

Raising taxes or allowing inflation to erode the real value of debt are also possible, but neither is ideal. Taxing the middle class is politically risky, and inflation has mixed consequences. In short, there’s no easy fix—but the sooner the conversation starts, the better.

Moody’s Downgrade: A Wake-Up Call

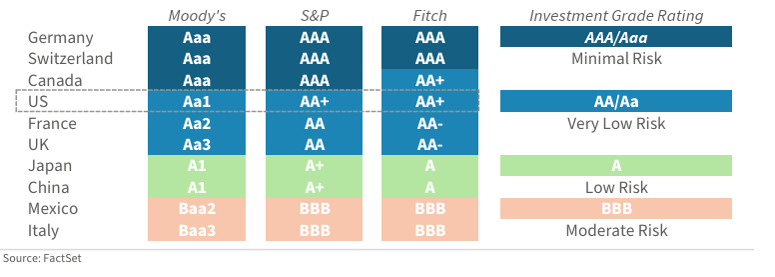

Moody’s recently downgraded the U.S. credit rating from Aaa to Aa1, citing unsustainable debt growth. This follows earlier downgrades by S&P (2011) and Fitch (2023). While symbolic, it doesn’t change much for bondholders—U.S. Treasuries remain a global safe haven.

How Do Other Countries Compare?

Only Germany, Switzerland, and Canada still hold a perfect AAA rating from all three major agencies. But their bond markets are much smaller than the U.S.—Germany’s, for example, is less than a quarter the size. The U.S. remains the deepest and most liquid bond market in the world.

A Bond Opportunity in Disguise

Despite the downgrade, long-term Treasuries now offer yields close to 5%—levels not seen since 2007. For income-focused investors, this is an attractive entry point. Bonds can provide predictable cash flow and capital protection, especially in a volatile equity environment.

Bottom Line: Stay Vigilant, Stay Invested

The U.S. downgrade is a reminder—not a crisis. The fundamentals of the U.S. economy remain strong, but fiscal discipline is urgently needed. For investors, this is a time to be selective, stay diversified, and consider high-quality bonds as a core part of a resilient portfolio.

The information contained herein has been prepared from sources believed reliable but is not guaranteed by Raymond James & Associates, Inc. (RJA) and is not a complete summary or statement of all available data, nor is it to be construed as an offer to buy or sell any securities referred to herein. Additional information is available upon request. Investing involves risk and you may incur a profit or a loss. The value of fixed income securities fluctuates and investors may receive more or less than their original investments if sold prior to maturity. Bonds are subject to price change and availability. Investments in debt securities involve a variety of risks, including credit risk, interest rate risk, and liquidity risk. Investments in debt securities rated below investment grade (commonly referred to as “junk bonds”) may be subject to greater levels of credit and liquidity risk than investments in investment grade securities. Investors who own fixed income securities should be aware of the relationship between interest rates and the price of those securities. As a general rule, the price of a bond moves inversely to changes in interest rates. Diversification does not ensure a profit or protect against a loss. Past performance is no assurance of future results.