In light of this, how can new financial instruments such as stablecoins be facilitated, and how can legacy systems be modernized?

According to the latest report by Citi Institute, titled “Digital Dollars: Banks and Public Sector Drive Blockchain Adoption”, with the tailwinds of regulatory support and factors such as the growing integration of digital assets into traditional financial institutions and a favorable macroeconomic environment, demand for stablecoins is expected to increase.

In this trend, the report considers blockchain’s potential to be a key lever. “At a global level, government processes remain largely a series of discrete, isolated steps that still rely on large volumes of paper and manual labor. Blockchain offers significant potential to replace existing centralized systems with smoother operational efficiency, better data protection, and reduced fraud,” the institution notes.

However, it acknowledges that significant risks and challenges persist. These include vulnerability to potential fraud, concerns about confidentiality, and secure access to digital assets.

Trends Supporting the Growth of Stablecoins

According to the report by Citi Institute, 2025 could be for blockchain what ChatGPT was for artificial intelligence in terms of adoption in the financial and public sectors, driven by regulatory changes.

It is estimated that the total circulating supply of stablecoins could grow to $1.6 trillion and up to $3.7 trillion in an optimistic scenario by 2030. That said, the report notes that the figure could be closer to half a trillion dollars if adoption and integration challenges persist.

“We expect the supply of stablecoins to remain predominantly denominated in U.S. dollars (approximately 90%), while non-U.S. countries will promote central bank digital currencies (CBDCs) denominated in local currency,” the report states.

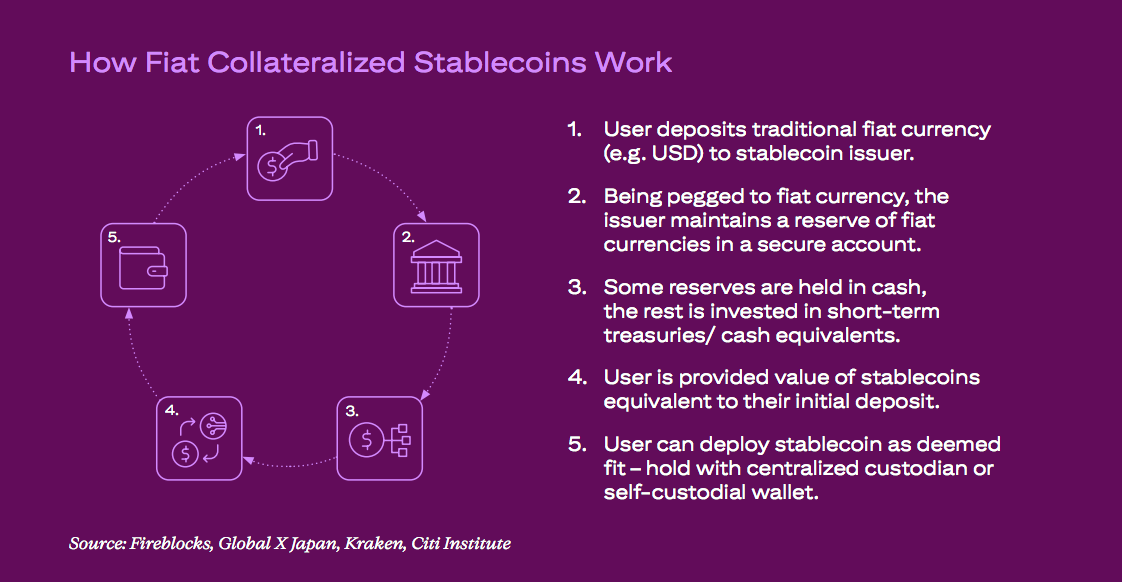

Regarding the regulatory framework, it points out that in the U.S., stablecoins could generate new net demand for U.S. Treasury bonds, with stablecoin issuers becoming some of the largest holders of these bonds by 2030. “Stablecoins pose some threat to traditional banking ecosystems by replacing deposits, but will likely offer banks and financial institutions opportunities for new services,” notes Citi Institute.

The Role of the Public Sector

Finally, the document notes that blockchain adoption in the public sector is also gaining ground, driven by a continued focus on transparency and accountability in public spending, as demonstrated by the DOGE (Department of Government Efficiency) initiative from the U.S. government and blockchain pilot projects from central banks and multilateral development banks.

According to the report, key uses of blockchain in the public sector include: spending tracking, subsidy distribution, public record management, humanitarian aid campaigns, asset tokenization, and digital identity. “Although initial on-chain volumes from the public sector will likely be small, and risks and challenges remain considerable, increased interest from the public sector could be a significant signal for broader blockchain adoption,” the report concludes.

What’s Happening in the Rest of the World?

In the case of the European Union, the ECB has passed the halfway mark in the preparation phase of the digital euro project, which began in November 2023. The decision to move to the next phase is scheduled for October 2025, and the final decision on its launch is subject to the adoption of a legal framework.

“The second ECB report on preparations for the digital euro, published in December 2024, highlights significant progress in key areas such as updating digital euro standards, collaboration in user-centered design, selecting potential providers for the digital euro service platform, and proactive engagement with stakeholders,” explains Milya Safiullina, analyst at Scope Ratings.

According to Safiullina, most countries exploring central bank digital currencies (CBDCs) are focused on improving payment systems, financial inclusion, and the effectiveness of monetary policy, while also addressing challenges such as privacy and regulatory frameworks. In her view, countries are making progress, but each has different priorities, ranging from financial sovereignty to reducing reliance on foreign currencies or improving payment efficiency.

“More than 130 countries are exploring the creation of CBDCs, and over 60 are in advanced stages of development, pilot testing, or launch, although only four (Bahamas, Zimbabwe, Jamaica, and Nigeria) have implemented CBDCs. The digital yuan is in an advanced pilot phase. Other major economies are actively researching or testing CBDCs, though they remain in earlier stages,” the analyst highlights.