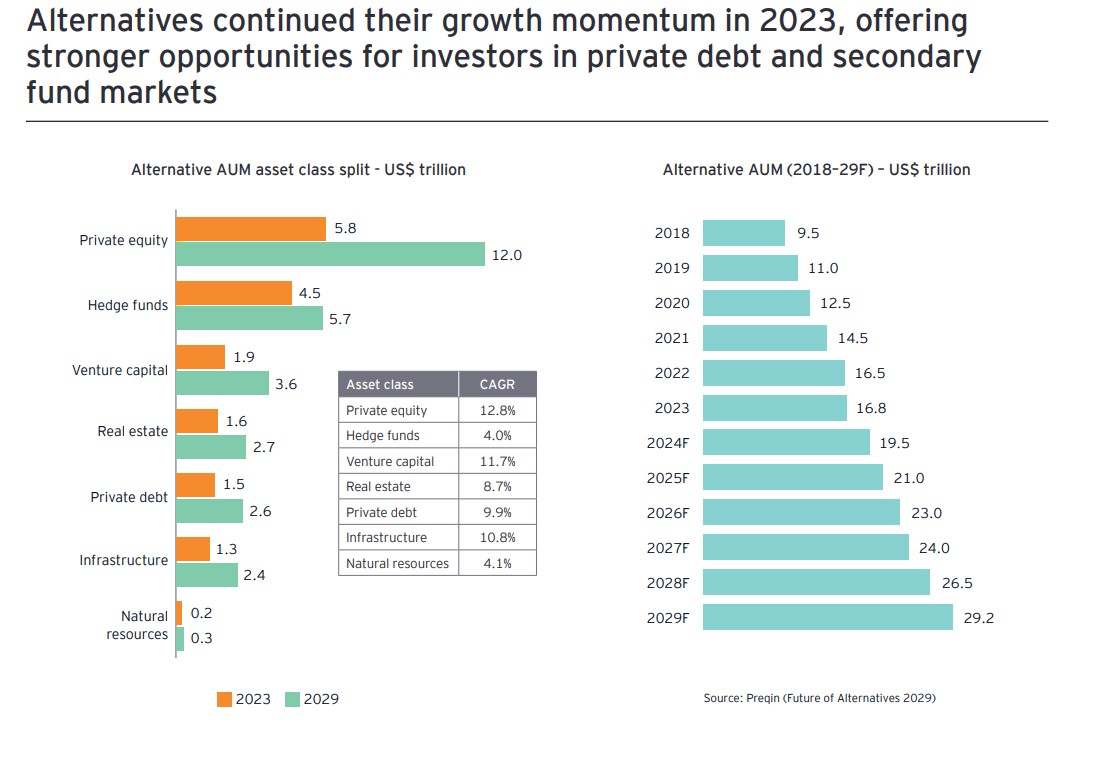

Despite this volatile context, alternative investments have experienced continuous growth. Alternative assets under management rose from $13.3 trillion at the end of 2021 to $17.6 trillion by mid-2024, and they are expected to reach $29.2 trillion by 2029. The industry is not only larger than before, but also increasingly diversified and sophisticated, blurring and merging the lines between traditional financial segments.

According to EY in its report “The EY Global Alternative Fund Survey”, based on a sample of 400 alternative fund managers and institutional investors, we are witnessing a robust growth landscape in terms of assets, supported by high investor satisfaction levels and ambitious expansion plans by alternative fund managers across North America, Europe, and Asia-Pacific.

“Growth forecasts are also positive. Alternative fund managers and the investors who entrust their capital to them expect the coming years to bring continued growth and increased asset allocations. Infrastructure, private equity, and secondary funds are considered some of the asset classes with the greatest potential for the future,” the document notes.

According to the consulting firm, one of the most surprising findings of the survey is the crucial role that individual investors and their private capital funds are playing as a new frontier of growth in the industry.

According to the consulting firm, one of the most surprising findings of the survey is the crucial role that individual investors and their private capital funds are playing as a new frontier of growth in the industry. Moreover, it considers the demand for greater accessibility to be significant, but notes that the democratization of the sector also presents challenges. For EY, the need for education, regulatory compliance, and efficiency will force many alternative fund managers to make significant and far-reaching changes to their business models.

Despite this volatile context, alternative investments have experienced continuous growth. Alternative assets under management grew from $13.3 trillion at the end of 2021 to $17.6 trillion by mid-2024, and are expected to reach $29.2 trillion by 2029. The industry is not only larger than before, but also increasingly diversified and sophisticated, blurring and merging the boundaries between traditional financial segments.

According to EY in its report “The EY Global Alternative Fund Survey”, based on a sample of 400 alternative fund managers and institutional investors, the outlook is one of strong asset growth, supported by high investor satisfaction levels and ambitious expansion plans from alternative fund managers in North America, Europe, and Asia-Pacific.

“Growth forecasts are also positive. Alternative fund managers and the investors who entrust their capital to them expect the coming years to bring continued growth and larger asset allocations. Infrastructure, private equity, and secondary funds are considered some of the asset classes with the greatest potential for the future,” the document states.

According to the consulting firm, one of the most surprising findings of the survey is the crucial role of individual investors and their private capital funds as a new frontier of growth in the industry. Furthermore, it notes the strong demand for accessibility, but also highlights that democratization brings new challenges. For EY, the need for education, regulatory alignment, and operational efficiency will require many alternative asset managers to undergo major, transformative changes to their business models.

Growth Drivers in the Industry

When discussing growth levers, the report points out that diversification is emerging as another key driver. “Many alternative fund managers are seeking to expand their range of investment options and take advantage of booming markets such as private credit or new technologies like tokenization. To ensure that diversification fuels growth—and not just complexity—creativity, investor engagement, and a clear strategy will be essential,” the report explains.

In this context, it is not surprising that artificial intelligence (AI) is a dominant theme in optimizing operating models and increasing productivity. According to EY, expectations are high and investment in AI is rising rapidly, but many questions remain about how to implement it effectively. In some cases, alternative fund managers and investors have surprisingly different expectations. “For AI to succeed in this sector, data, human talent, and investor support will be key,” the report notes.

EY’s Conclusion: Three Recurring Themes

As alternative fund managers and investors plan for profitable growth, EY‘s analysis reveals three recurring themes:

The need for a clear strategy

The importance of innovation

The implementation of scalable operating models—to optimize distribution, technology, talent, transparency, and trust

“The relevance of these factors is reinforced by the current market uncertainty, which is creating an increasingly dynamic competitive environment, characterized by rising strategic and operational challenges. Looking ahead, we foresee a potential blurring of traditional boundaries, greater fee pressure, and the emergence of asymmetric market dynamics similar to those long seen in traditional asset management,” the report states.

To survive and thrive in this dynamic environment, EY offers a clear yet complex piece of advice: firms must embrace transformation without losing the qualities that make them unique—or the capabilities that have driven their success so far.