The European Central Bank (ECB) has responded to rising economic risks and the deterioration of financing conditions in the euro area with a new deposit rate cut to 2.25%. The decision was unanimous. However, the most noteworthy aspect was ECB President Christine Lagarde’s perspective on the potential impact of Trump’s tariff policies on the eurozone economy—and what that means for the ECB.

Despite this, Ulrike Kastens, Senior Economist for Europe at DWS, highlighted that Lagarde did not commit in advance to any future interest rate path. “The high level of uncertainty still demands a focus on data dependence and meeting-by-meeting decisions, especially since the impact of the tariff policy is unclear. While downside risks to the economy dominate, the impact on inflation is less certain, as it also depends, for example, on potential EU retaliatory measures,” Kastens noted.

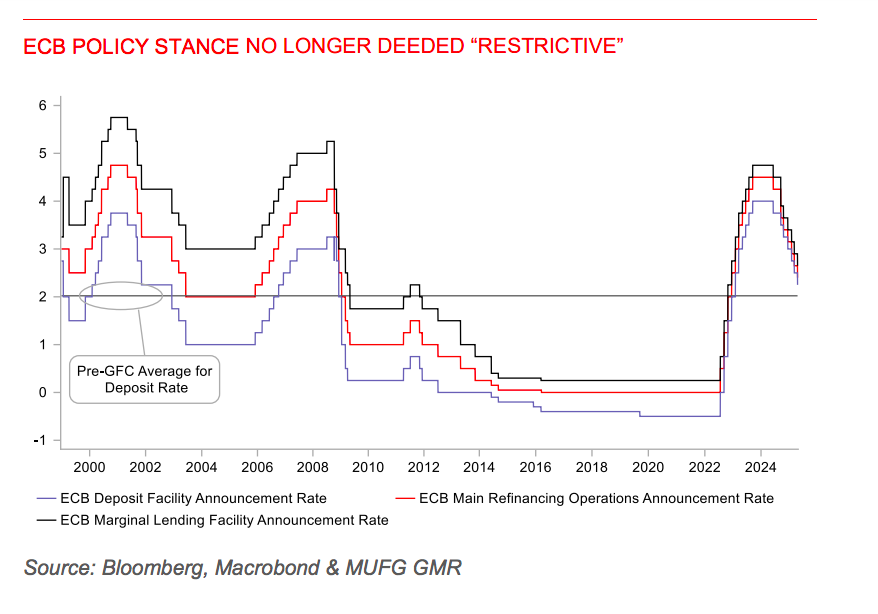

According to her analysis, unlike the post-March meeting statement, it was not declared that monetary policy is “significantly less restrictive.” “For Lagarde, labels like ‘restrictive’ or ‘neutral’ are not helpful to characterize monetary policy because, in a world full of disruptions, monetary policy must be calibrated to achieve sustainable price stability. That is the only destination,” the DWS economist emphasized.

Lale Akoner, Global Markets Analyst at eToro, agreed with Kastens that the biggest surprise was that the ECB no longer labeled monetary policy as “restrictive” in its statement, though it also did not claim to have entered “neutral” territory. In her view, this change suggests the possibility of further rate cuts amid rising political uncertainty stemming from U.S. tariff decisions and their impact on European growth.

“Given the growing political uncertainty worldwide, the ECB is expected to adopt a more data-dependent approach, similar to the Fed. Nonetheless, while tariffs pose downside risks to growth, increased European spending on defense and infrastructure could partially offset them. If rising deficits threaten debt sustainability, the ECB may have to resume large-scale bond purchases through its Transmission Protection Instrument (TPI),” Akoner explained.

What Comes Next?

According to Konstantin Veit, Portfolio Manager at PIMCO, it’s clear that downside risks to growth currently outweigh concerns over temporary price increases or the state of public finances. He recalled that Lagarde stated, “There is no better time to depend on the data,” reaffirming that decisions will continue to be made on a meeting-by-meeting basis, and that data flows will determine the future path of monetary policy.

Looking ahead, Veit considers it likely that official rates will continue to gradually fall and that the ECB is not yet done with rate cuts. “The current pricing of the terminal rate, around 1.55%, suggests a slightly accommodative destination for the deposit facility rate. In June, with new staff projections, the ECB should be in a better position to determine whether a clearly stimulative policy will be necessary,” he said.

Orla Garvey, Senior Fixed Income Manager at Federated Hermes, noted that Lagarde balanced her changes in language. “The disinflation process is seen as ongoing, and growth is under short-term pressure, which likely supports current market pricing for rate cuts. This is consistent with the progress already made on inflation, and the impact of a stronger currency and lower oil prices. The ECB continues to keep all options open without committing in advance to any specific interest rate path,” Garvey explained.

Roelof Salomons, Chief Strategist at the BlackRock Investment Institute, also agreed that the direction of interest rates remains downward, though he sees some roadblocks. “The ECB may need to adjust its path to respond to both the tariff pass-through and fiscal stimulus in Europe, without much new data since the last meeting to guide decisions. President Lagarde appeared more concerned about growth risks than inflation,” Salomons said after the ECB’s April meeting.

In Salomons’ words: “When you’re running downhill, sometimes you have to keep running not to fall.” In the short term, he sees a slightly higher probability of the ECB cutting rates below the neutral level, which he currently estimates at around 2%. In the long term, however, he acknowledges that increased fiscal spending will raise borrowing needs and push neutral rates higher. “The global economy has endured several shocks. Tariff uncertainty is another one affecting both demand and supply, raising the cost of capital. Europe is not immune, but remains a relative beacon of stability thanks to strong balance sheets and policymakers’ ability (and willingness) to respond. Greater unity and a pro-growth agenda in Europe could significantly boost demand,” concluded the BlackRock expert on the challenge facing the ECB.

At Amundi, they expect the ECB to continue cutting rates until its official interest rate reaches 1.5%. And, if financial conditions continue to tighten, they also expect the ECB to slow the pace of its balance sheet reduction. All of this aligns with macroeconomic expectations which, according to the analysis of Mahmood Pradhan, Head of Global Macro at Amundi Investment Institute, are characterized by a disinflation process that is on track and growth prospects that have deteriorated due to rising trade tensions.

“The eurozone economy has developed some resilience to global shocks, but growth prospects have deteriorated due to increasing trade tensions. The rise in uncertainty is likely to dampen household and business confidence, and the adverse and volatile market reaction to trade tensions may have a restrictive impact on financing conditions. These factors may continue to weigh on the eurozone’s economic outlook,” concludes Pradhan.